Our latest case study highlights a significant issue faced by many successful business families. Names and other key identifiers have been changed for privacy reasons, but the situation and key issues presented here are real.

Nilam Patel was looking for a win-win. As one of Canada’s largest auto parts wholesalers, finding mutual wins had been his operating style with customers for years. But he wanted a different win-win this time. This one involved planning his charitable legacy, while at the same time covering the tax burden on his estate.

Nilam’s charitable legacy was becoming a driving force in his life. Money had always been scarce for his family growing up. His parents had immigrated to Canada with very little – and they’d struggled to get ahead. He’d seen the toll those struggles took on his parents’ health firsthand. Both had died in their early 70s.

Nilam’s parents had worked tirelessly to ensure he and his younger sister had access to the education opportunities the elder Patels never enjoyed. And Nilam had also received generous support from many others to get through school and establish himself. This created a strong desire to give back in a substantial way.

And he now had the means to do it.

Nilam had started his business 30 years ago but had only recently completed a business valuation as part of his charitable and tax planning. He found it hard to believe that a kid who grew up in subsidized housing in Metropolitan Toronto now had a business worth north of $600 million – and he was proud.

Nilam was less proud of his progress in covering the $150 million in estate taxes that lay ahead for he and his family. He knew he’d be saddling his children with a large tax bill if he didn’t soon put some effective estate planning strategies in place.

Now 60, Nilam and his wife, Lorelei, had three children in their late 20s and early 30s. He’d begun exploring estate tax solutions with his advisors a few years earlier when he turned 50. He had executed an estate freeze then, locking in the gains and tax liabilities that he’d be responsible for. That amount was about $75 million. To cover that liability, Nilam’s financial advisors brought forward a quick solution that ticked off several important boxes in his estate planning. To Nilam’s surprise, it involved donating his preferred shares to a charitable foundation through his will upon death.

The solution made sense. Nilam had a strong desire to give back through charitable gifts. And, at that time, none of his children had an interest in the family business. All three were each focused on forging a different path. His eldest son eventually became a dentist. Another son was exploring a career in the performing arts. Nilam and Lorelei’s youngest, daughter Emma, was studying at business school, but didn’t seem interested in the world of auto parts – or family business for that matter.

COVERING TAXES THROUGH A GIFT AT DEATH

While there were many complexities to the solution, the premise was simple. Through his will at death, Nilam would donate his preferred shares to a charitable foundation. The tax credits generated would offset the estate tax liability created by the growth in business value. Nilam’s family would still retain control of the company through his common shares.

While the proposed estate tax solution seemed like a great fit at the time, there had been one recent change in the family – one Nilam hadn’t expected. It centred around the growing business interests of Emma. She’d had a change of heart upon graduating from business school and wanted to apply what she’d learned to the family business. She’d even impressed her dad with some back-of-the-napkin ideas for growth.

Nilam was still committed to moving forward on his philanthropic goals. But should he be giving away half of his company? He couldn’t know for sure what would unfold, but it was possible that Emma could run the family business – and grow it – for decades, if afforded the opportunity. A gift of his preferred shares would create a significant barrier to business growth in the future. The company would have to buy out the preferred shares if the charity couldn’t or wouldn’t hold them. And even if the charity agreed to hold the preferred shares, the company would have to fund the annual disbursement quota. This was equal to 3.5% of the charitable capital each year.

Now what?

ESTATE PLAN: THE SECOND CHAPTER

Nilam felt that the current plan put the business at risk after his death. It would be severely hampered if his children had to raise cash to buy out the preferred shares. And, if his shares weren’t cashed out, he didn’t want to saddle the business and his children with annual disbursement quota payments either. With one of his children now interested in the business, he needed to evolve his plan.

Nilam went looking for alternatives. That lead to a meeting with specialist advisors to business families. The advisors listened as Nilam described his goals for his business, his charity, and his family. Then, they looked under the hood of the charitable donation strategy. Could it help Nilam achieve his goals?

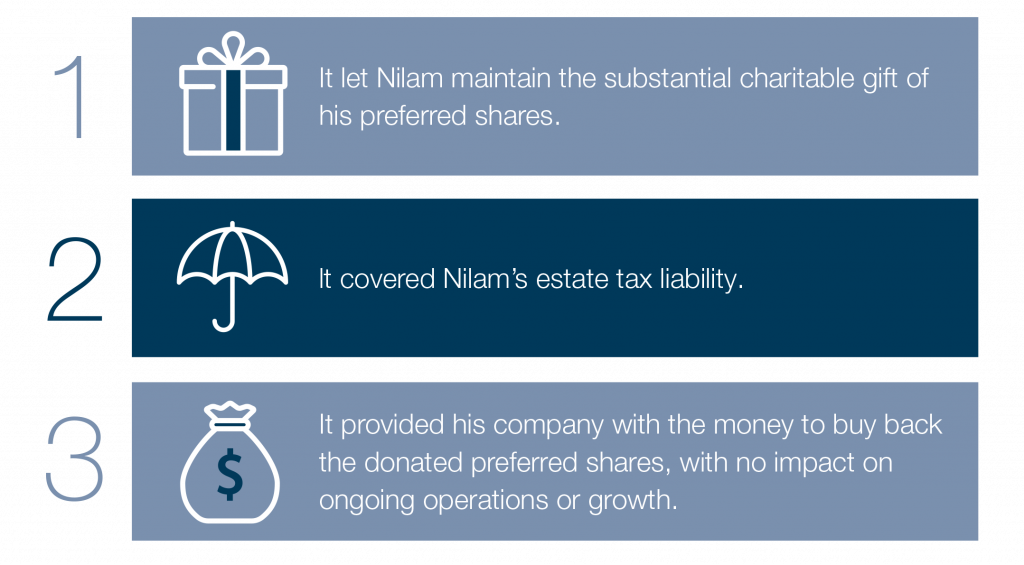

What emerged was new information and options involving life insurance-based strategies. The advisors proposed a strategy where corporate-owned life insurance provided the liquid assets to buy out the preferred shares from the charity – and cover Nilam’s estate tax liability. This solution achieved all three of Nilam’s goals:

Nilam and his advisors worked to put the solution in place. It was far more cost effective than all other solutions presented. It also offered his daughter a full opportunity to grow the business – and keep it in the family’s control.

The solution also got Nilam thinking more about his immediate charitable desires. Emma had officially joined Nilam’s team in the business. She began the process of learning the ropes, gaining experience, and putting some of her ideas for growth into action.

With his own taxes covered – and the business poised to benefit from Emma’s growing contribution – Nilam felt in a more comfortable position to donate to charity on an ongoing basis. To that end, he put targets in place to ensure a percentage of his company’s profits were donated each year. He and Lorelei even began working with a philanthropy consultant that helped to target – and maximize the impact of – this ongoing giving.

Nilam Patel was always looking for the win-win. He was thrilled that in this important area of his life, he’d managed to do just that.

Paul Russell is a Freelance writer based in Toronto.