At CMG, we know that for Canadian business families, safeguarding wealth across generations is more than making smart money moves; it’s a means of preserving a family’s legacy. Modern Portfolio Theory (MPT) has long been a foundation in the world of investment portfolio management. The added benefit of combining MPT with participating whole life insurance empowers business families to optimize the risk-return relationship within their portfolios, giving them another tool in their arsenal to steward the wealth they’ve worked hard to accumulate.

Now, imagine this scenario:

Investco, a family holding company with significant holdings in various securities, has a mandate to balance its portfolio with growth and security to sustain the family legacy. Not only is there a mandate to balance growth and security, but it’s also necessary to optimize the portfolio, given a level of growth or security. Modern Portfolio Theory (MPT) — a theory that highlights the importance of diversification across assets — can show that adding participating whole life insurance to the portfolio of assets can provide either greater levels of return for the same volatility or a lower level of volatility for the same level of return.

The efficient frontier

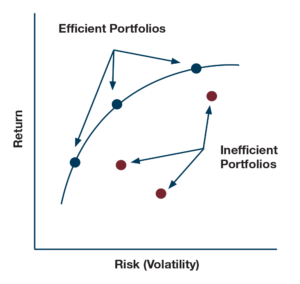

At the core of MPT is the concept of the efficient frontier. This is a graphical representation of the set of optimal portfolios that offer the highest expected return for a defined level of risk.

- Portfolios on the efficient frontier are considered efficient because they provide the best possible returns for their associated risks.

- Portfolios that fall below this frontier are deemed inefficient, as they fail to deliver sufficient returns relative to their risk levels.

The key to expanding the efficient frontier lies in the correlation between the new assets and those already in the portfolio.

Putting MPT into practice

To construct an efficient portfolio, investors need to consider the relationship between different assets, which is quantified by their correlation. Assets that have low or negative correlations with one another can significantly reduce overall portfolio risk. When one asset’s value declines, another asset’s value may rise, offsetting the loss. With this approach, investors can set up a more stable return profile.

For example:

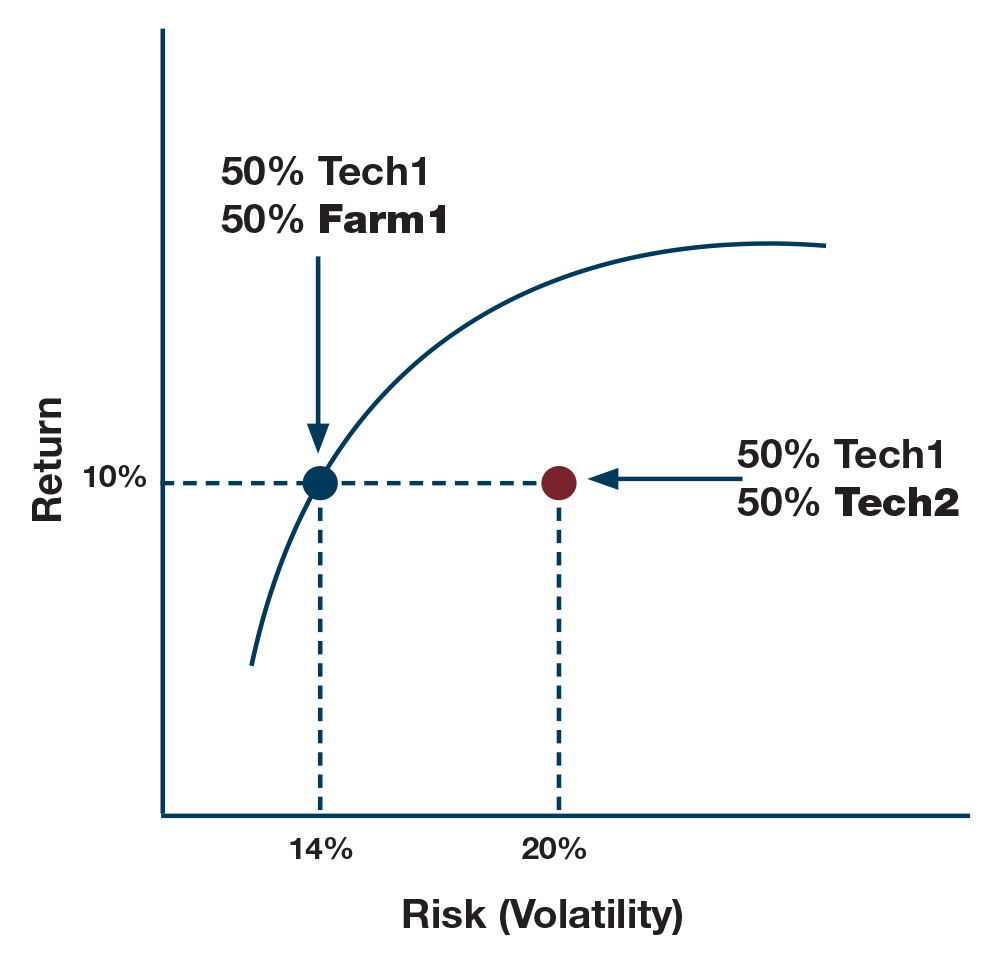

- Consider a portfolio of two technology stocks, each held in equal quantities by value: Tech1 and Tech2. Each has an expected annual return of 10% and an annual volatility of 20%. Let’s also assume that the prices of these stocks have a correlation of 1 (this would mean that they fluctuate in exactly the same way – unrealistic in practice, but appropriate for the purpose of this example). The portfolio would then have the following metrics (see figure 1 below).

- Now, suppose there is a third stock, Farm1, which is a stock in the agricultural industry and has very little in common with either Tech1 or Tech2. The expected return and volatility of Farm1 are 10% and 20%, respectively (the same as Tech1 and Tech2). However, its correlation with Tech1 is zero.

- If we make a portfolio with equal weights of Tech1 and Farm1, we get a portfolio with a return of 10% and a volatility of 14%. By diversifying the risk using uncorrelated assets, we achieve the same expected return with lower risk (the return of the new portfolio remains at 10%, but the volatility is now 14% as opposed to 20%).

In other words, we’ve moved from an inefficient portfolio to an efficient portfolio:

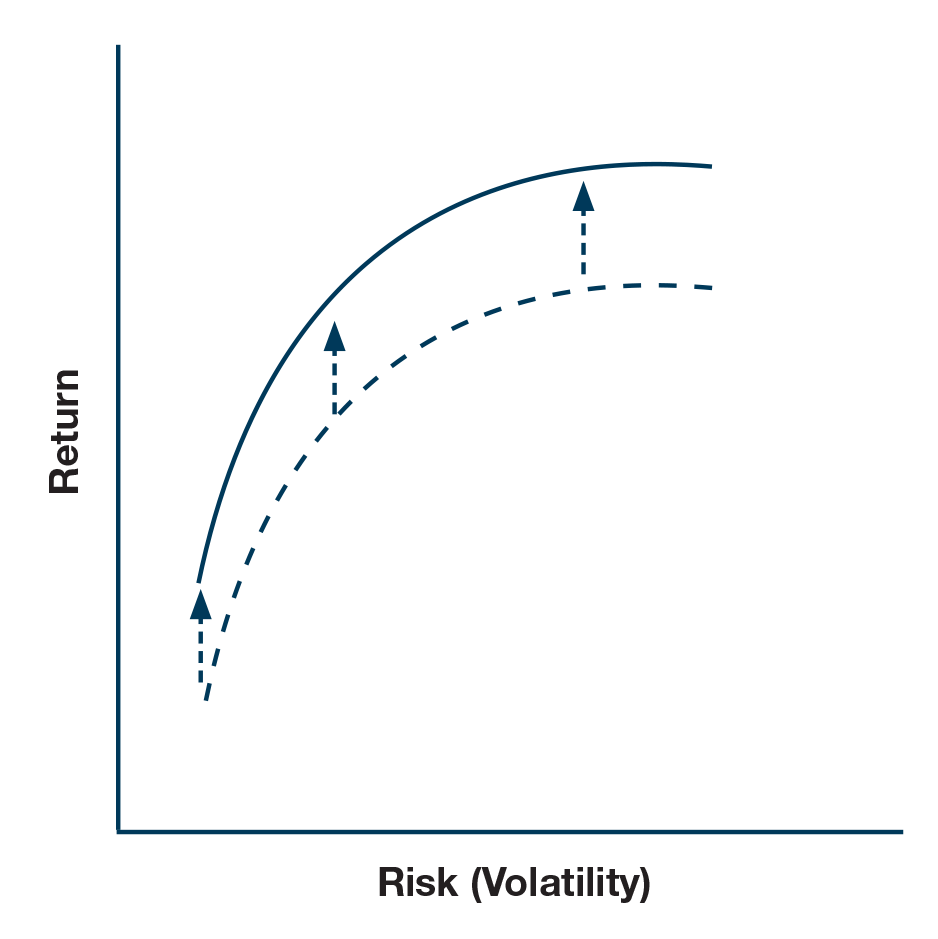

Introducing additional investment options to the investment universe can significantly enhance the efficient frontier. When new assets, like participating whole life insurance, are added to a portfolio, they create opportunities for better risk-return trade-offs, leading to a more extensive and potentially more efficient frontier (i.e. “shifting” the efficient frontier upward):

Participating whole life insurance

Participating whole life insurance, which offers both a death benefit and a cash value component that grows over time, can provide unique advantages. For example:

- Both the cash value and the death benefit of a participating whole life insurance grow on a tax-exempt basis through the crediting of policyholder dividends

- Once a dividend is credited, it’s vested, and therefore increases the guarantees in both the cash value and the death benefit (meaning that the cash value and death benefit are not subject to downside market fluctuation)

- Policy deposits are made into the participating account, which has relatively low investment fees, institutional management, and grants the policyholder access to certain investment types typically not available to retail investors

These attributes lower the correlation between participating whole life insurance and other market risks to which a portfolio is typically exposed. Thus, introducing par whole life insurance can lead to the discovery of previously unattainable combinations of risk and return. By analyzing the risk-return profiles of this asset in conjunction with existing holdings, investors can identify portfolios that offer higher expected returns for the same level of risk or lower risk for the same expected return.

Furthermore, adding participating whole life insurance allows for finer granularity in asset allocation. Investors can strategically adjust their portfolios to align with specific financial goals, such as providing a death benefit to beneficiaries while also accumulating cash value that can be accessed during their lifetime. This dual benefit enhances the ability to construct a portfolio that stays on or even above the efficient frontier.

Adding new investment options, such as participating whole life insurance, is vital for improving investment strategies and enhancing the efficient frontier. By investing in different types of assets, investors can better control risk and increase returns. This helps them reach the financial goals of the portfolio while also adapting to changing markets in a complex financial landscape.

Kyle Leistner is a Principal at CMG and a qualified actuary, bringing in-depth expertise on the complexities and benefits of life insurance for Canadian business families.

Download and read this article as a PDF here.