Our latest case study highlights an estate planning challenge many business families face: how to best fund their inevitable tax liabilities? Names and other key identifiers have been changed for privacy reasons, but the situation and key issues presented here are real.

Liam Beck had a big tax problem. The good news – the liability belonged to someone else. The bad news – the responsibility for solving the problem belonged to him.

Liam headed the Toronto family office for the Wentworth family – three brothers who inherited Wentworth Developments from their father, George Wentworth. George had started buying farmland in the GTA in the late 1960s. In the five decades since, Wentworth Developments had grown into a multi-purpose real estate conglomerate, with commercial, residential and office holdings across Canada.

As with many of his generation, George had successfully deferred his estate tax to the next generation – his three sons, who were now all in their late 50s and early 60s. When they were younger (in their 30s and 40s) the sons had used the same techniques of estate freezing and trusts to defer their own tax liabilities to future generations.

Or so they thought. The 21-year deemed disposition rule for the trusts was now only three years away, and there was no consensus amongst the Wentworth brothers on what they should do with the $1 billion of value built up since the estate freeze. Between them, the brothers had seven children – each with widely varied skills and abilities, particularly when it came to business. With the distribution date getting closer, there were three important issues on which Liam needed input and direction from the Wentworth brothers:

-

The potential tax bomb. While the trust distribution in three years wouldn’t trigger any immediate tax, the unexpected death of a beneficiary would. Under the terms of their shareholders agreement, the company would be obliged to redeem enough shares to pay the tax. Since the company’s value had grown considerably since the freeze, it meant that each of the three families was sitting on a potential tax liability of tens of millions of dollars.

-

A lack of liquidity. Wentworth Developments had long used most of its cash (and equity) to grow the business. It’s how many business families operate. As a result, the company lacked both the liquidity – and the family consensus – to set aside additional funds to handle a particular family’s tax problem. Many of the real estate projects Wentworth invested in were large deals, and involved development partners as coinvestors. These deals would take years to unwind, and simply couldn’t be undone on short notice. In addition, most of the holdings that Wentworth Developments owned outright were pledged as collateral for bank guarantees related to the funding of these larger developments.

-

Family conflict. Liam had raised the tax bomb and liquidity issues with the three brothers on several occasions in the past and it had always sparked a fierce disagreement. While the brothers worked together in the business, their lives and values differed greatly. The eldest brother wanted money directed to the issue immediately – while the youngest refused to take any action that would impact either business growth or his family’s lifestyle. While each family had the same tax burden, they couldn’t agree on a solution.

LIFE STYLE DIFFERENCE

To build the liquidity needed to cover any tax liabilities, Liam estimated that each family would need to set aside several million dollars each year. But it was clear the brothers would never agree on this strategy – or the amount needed. Lifestyle differences lay at the heart of these tensions.

-

The eldest, Brian, lived a successful, but measured, life. Apart from some standard perks of wealth – a nice home, private schools, a cottage for summer fun – the family lived far below its means. Brian was content to spend less and build his private wealth.

-

The family of the youngest son, David, was the opposite. They had invested in a variety of outside business interests, including three high-end restaurants, and were about to open a nightclub with other partners. They also had significant ongoing lifestyle costs. Despite their wealth, the family was highly leveraged financially.

-

The middle brother, Charles, had no children. But he had recently married for a fourth time, and was saddled with a string of past divorce settlements that left him short on cash. Charles was also heavily involved in philanthropy, and generous with the millions he received each year in dividends.

When Liam initially discussed the solution with David, and told him that each family would need to commit to setting aside roughly $5-10 million each year to build liquidity, David’s reply was immediate and direct: “Not on your life, Liam. We’ll take our chances.”

Charles didn’t like the idea either.

Not surprisingly, Brian – who led a frugal life compared to David – was the most receptive. He understood the dangers of not addressing the problem. Furthermore, Brian was upset about being stonewalled by David and Charles. He was barely on speaking terms with both brothers.

So the Wentworth brothers were divided – and now Liam’s task was either to negotiate a compromise with each of the families, or find a more affordable strategy.

THE 2% SOLUTION – A LOOK TO THE MOTHERSHIP

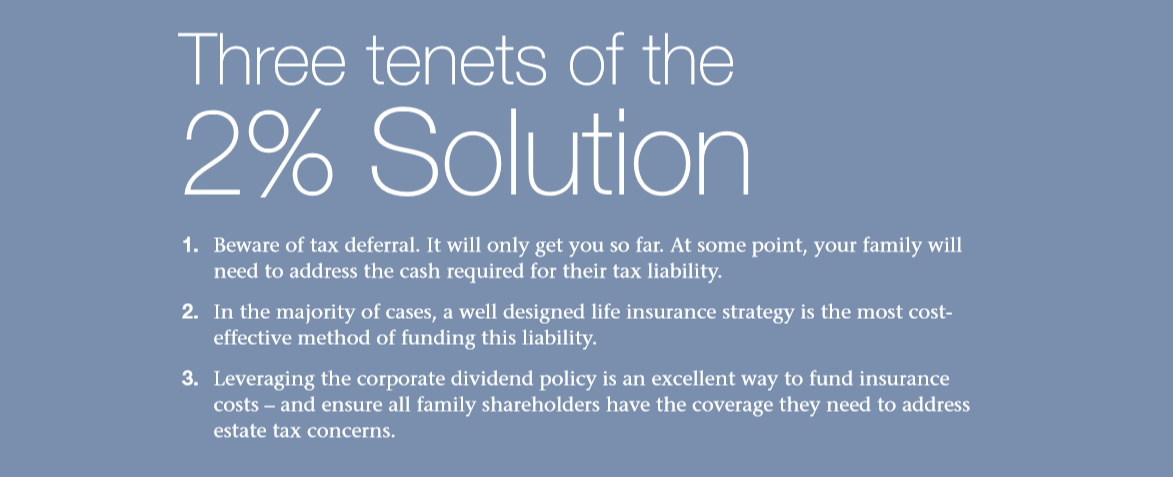

Liam was stuck, so he decided to consult an advisor who specialized in helping business families identify strategies to fund their large tax liabilities. The advisor set out some different funding options, including one that Liam had not considered. It was a strategy that didn’t rely on each family committing to fund their own liabilities. Instead, it relied on Wentworth Developments – the mothership – to fund and carry out the strategy, and at a much more affordable cost.

The strategy was centered on a unique approach to life insurance. Rather than a funding solution that ate up a substantial chunk of each family’s income, the company itself would set aside a small percentage of profits annually, through dividends to their joint holding company, to fund a life insurance strategy for each family’s unique needs. Proceeds from the insurance, when paid, would then be used by the holding company to redeem shares or pay a dividend to the family in need.

After years of struggle on the topic, Liam finally began to see a path forward in breaking the family logjam. For a family-owned business like Wentworth Developments, well designed dividend payments could do double duty: they could both provide a level of income that family members needed to enjoy their desired lifestyle, and protect the business from the effect of tax bomb shares. The part Liam had been missing, until today, was the business protection piece.

Wentworth Developments’ current dividend distribution policy (if you could call it that) was to retain about 80-90% of profits each year to reinvest in its core real estate business. The balance, depending on the year, was paid out to the individual families for their personal use. Working with his specialized estate planning advisor, Liam was able to design a potential solution that would require only a small additional dividend – a fraction of the company’s profits – and with little or no impact to the dividend paid to the three families.

When Liam and the advisor presented the solution to the three brothers, all three liked what they heard, and agreed that this was an affordable alternative they could live with. David called it the “2% solution” and wondered why they hadn’t looked at it sooner.

Liam was delighted when he realized that the strategy effectively bypassed their lifestyle differences by making the insurance funding an obligation of the family company, and not of each of the families. The structure would reduce the possibilities of future tensions, as the direction was clear and now a corporate responsibility.

PUTTING A PLAN IN PLACE

With an agreement reached, Liam knew that executing the strategy would take planning, commitment, and specialized expertise. He turned his focus to the three steps that lay ahead.

-

Confirming the mandate to direct 2% of corporate profits to fund the insurance. Liam negotiated with Wentworth Developments’ corporate CFO to put the new insurance mandate in place, and ensure there was dividend money available to fund the policies on an annual basis. Wentworth was a highly profitable company, with many of its profits invested back into the business to fund future growth. While the CFO believed that the insurance mandate might slow corporate growth somewhat in the near term, he also believed that the company could easily absorb this cost over time and that Wentworth’s robust growth could continue.

-

Educating the Wentworth families about the solution. A small portion of the dividends allocated for lifestyle needs would need to be redirected towards the funding of the estate tax liability. Liam and the family office would need to educate the Wentworth children and grandchildren on why this was being done – and the importance of covering this estate tax liability to protect the business and future dividend payments. The goal going forward was a balanced approach, with the company providing enough of a dividend to cover tax planning while also still allowing the shareholders to “lead a good life.”

-

Underwriting the life insurance program. Liam knew that high-value life insurance required specialized expertise, including the ability to assemble insurance syndicates and detailed knowledge of underwriting and pricing. And because insurance pricing could be extremely sensitive to even the slightest changes in health reporting, presenting complex health information clearly, succinctly and accurately could be instrumental in ensuring the best pricing for insurance products. He relied on his estate planning advisor to put the permanent life insurance program in place, one that maximized tax efficiency and was integrated with broader family office planning.

When it was all said and done, Liam and the three Wentworth brothers were pleased with the solution. It ended up being completed within a calendar year and, while there was a cost to putting this solution in place, the ongoing current costs paled in comparison to the potential damage the business and the Wentworth family members could suffer if a tax bomb hit without the liquid assets to cover it.

THE SHIFT IN DIVIDEND POLICY THINKING

For family-owned corporations, family members often rely on dividend income to fund their lifestyle commitments and goals. It’s an important use of corporate profits – and is arguably why the business exists in the first place.

But a shift in dividend policy to include the crucial element of estate tax planning can create important protection for the business – and ensure it continues to grow and generate income for future generations.

While the “2% Solution” isn’t an exact measure for every situation, it can provide important guidance to business families to prudently fund their estate tax liabilities – and protect their futures.

Paul Russell is a freelance writer based in Toronto.