Less than one week after the launch of the 50th anniversary celebration for his revolutionary fashion house, Giorgio Armani passed away on September 4, 2025. He was 91. Known as “Re Giorgio” (“King Giorgio”) for his reign in the fashion industry, the illustrious Italian designer was the sole owner of his iconic company.

Giorgio was born in Piancenza, a small town south of Milan. He began working in fashion at 23 years old after dropping out of medical school. In 1975, he sold his Volkswagen for US$10,000 to start a menswear line. That line would become one of the most influential fashion empires in history, transforming how the world dressed for power and redefining Italian luxury on a global scale.

With the support of key partners, including his late business co-founder Sergio Galeotti, his longtime creative collaborator Pantaleo “Leo” Dell’Orco, and his sister and “muse” Rosanna, Giorgio built a family-centred empire that remained fiercely independent. His nieces, nephew, and trusted collaborators worked alongside him in key roles, helping shape a brand that valued loyalty and collaboration as much as creativity.

At the time of his death, industry analysts valued his empire at over US$10 billion.

Creaghan McConnell Gould champions business families in Canada and around the world for their positive contributions to their countries, communities, and the global economy.

Below, we’ll explore how Giorgio Armani — the second richest man in Italy at the time of his death — planned for his legacy to live on through a meticulously designed succession strategy that preserves his creative vision, empowers his trusted collaborators, and guarantees long-term stability for his global empire.

A unified succession strategy

Giorgio created two separate wills — one business will for his company, and one personal will for his private assets, both updated in March 2025. When his wills were made public, the Armani executive committee released the following statement:

“It is immediately clear that Mr Armani’s intention to safeguard strategic continuity, corporate cohesion and financial stability for long-term development is confirmed at every stage, in line with what he had repeatedly shared with the press and his closest collaborators.”

Three key elements of Armani’s succession architecture

Giorgio’s will is specific and thorough, and accounts for a range of possible scenarios. It’s both an estate plan and a business plan. Three distinctive features of his strategy set it apart:

1. Early planning

Giorgio began his formal succession planning in 2016. He codesigned this plan with his family and those close to him, along with external advisors such as those on his Foundation Board.

2. The Giorgio Armani Foundation

Giorgio created the foundation to act as an impartial steward of his legacy, ensuring mission-driven continuity and protecting the company’s governance assets over time.

In 2016, he stated:

“I decided to create the Giorgio Armani Foundation in order to implement projects of public and social interest. The foundation will also safeguard the governance assets of the Armani Group and ensure that these assets are kept stable over time, in respect of and consistent with some principles that are particularly important to me and that have always inspired my activities as a Designer and an Entrepreneur.”

3. Separation of personal assets from business assets

Giorgio didn’t just want heirs who would inherit assets, but stewards who would continue his legacy. By separating his business assets and personal assets, he allowed for his loved ones to inherit his wealth while also being very deliberate about control of the company and preservation of brand identity.

Armani without Giorgio

Giorgio owned 99.9% of his eponymous company, with the remaining 0.1% owned by the Armani Foundation. While fiercely independent during his lifetime, he understood his company would have to adapt after his passing.

His will instructed his heirs to either sell or seek a market listing. It outlines a two-step disposal process, starting with an initial 15% stake. Priority will be given to French conglomerates LVMH and L’Oreal, or EssilorLuxottica — the world’s largest eyewear company — headquartered in Paris. Leo Dell’Orca is to guide the sales process, and Giorgio’s document states that he has the power to select another buyer if his preferred options are unavailable, provided they are from the same industry and of a similar size.

In the second phase, an additional stake between 30% and 54.9% is to be sold to the same buyer within five years of Giorgio’s death. If the sale fails, his heirs are to pursue an initial public offering in Italy or a market of equal standing.

Succession by design, not descent

This news surprised many, as Giorgio had persistently resisted any mergers or other dilution of his control over the business. He was known for being highly protective of both Armani’s independence and its Italian roots, and his philosophy and practice always prioritized creative autonomy. Referring to French luxury conglomerates and his determination never to be taken over by one of them, Giorgio once stated: “Why should I be dominated by one of these mega structures that lack personality?” in a 2023 Financial Times interview. He had rejected multiple acquisition attempts over the years from Gucci, the Agnelli family, and LVMH — the latter now first on his priority list for selling.

But unlike his industry peer Bernard Arnault of LVMH, whose succession plans for his own global empire we have also profiled, Giorgio had no children and no spouse to inherit. Without offspring to carry on his legacy and brand identity into future generations, Giorgio instead carefully curated a limited number of investor options who could purchase portions of the business. He was deliberate and thoughtful in structuring how the sale process plays out. He also provided alternatives if his preferred route cannot be executed, demonstrating pragmatism and thoroughness.

Bernard stated LVMH was “honored” to be named a potential partner, and said:

“Giorgio Armani […] built and led a global brand in terms of both style and industry. If we were to work together in the future, LVMH would be committed to further strengthening its presence and leadership around the world.”

This dramatic shift from his lifetime stance demonstrates that Giorgio understood the company would need to change in order to survive without him, even if that meant compromising the independence he’d insisted on during his life.

Still in the family

None of Giorgio’s plans came as a surprise to his heirs and closest collaborators. They had been thoroughly informed, which he had been carefully crafting and codesigning with his team for years. In 2016, he held a meeting with all involved parties to outline what would happen following his death. He established new governance rules and defined the guiding principles for the company’s future, and announced his intention to form the foundation to assist in laying the groundwork for the future of the company.

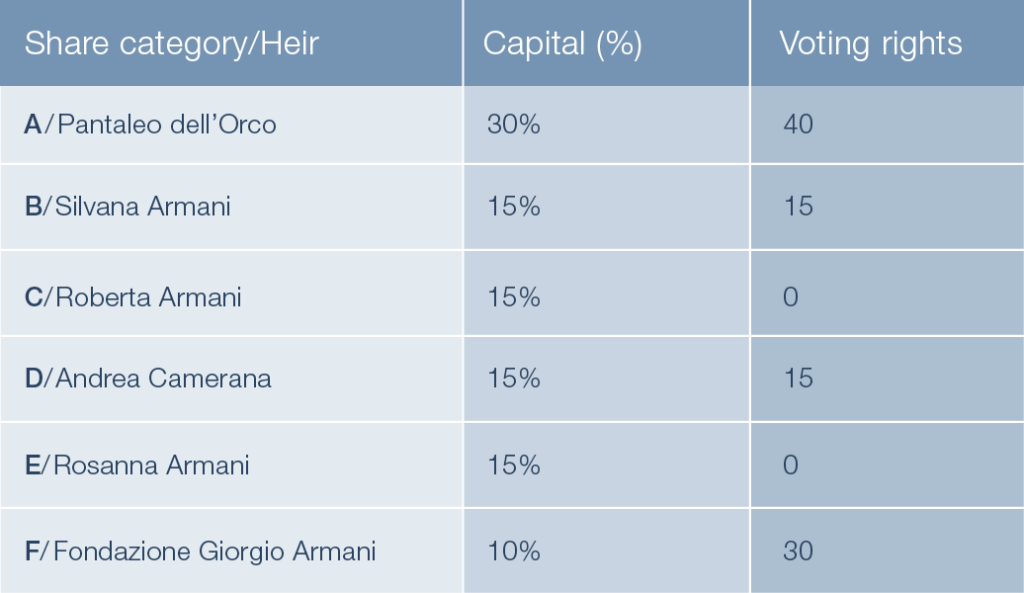

Those closest to Giorgio remain heavily involved in the business, and are all estimated by analysts to now be billionaires. He had no children, but passed on control and assets to those closest to him. Pantaleo “Leo” Dell’Orco, Giorgio’s business partner, life partner, and “right-hand man,” has been with the company since 1977. Dell’Orco has inherited control of the fashion empire and the largest share of capital and voting rights, along with the foundation. Dell’Orco and the foundation now control 70% of voting rights, and Dell’Orco holds a 30% stake in the business. The Foundation holds 10%.

The remaining 60% has been divided evenly among his familial heirs, including Giorgio’s sister, Rosanna; his niece, Roberta Armani, Head of Global and VIP Communications; his niece, Silvana Armani, who leads the womenswear line; and his nephew, Andrea Camerana, a company board member. Ownership will shift according to plan as Giorgio’s sales instructions are followed over the next few years. Dell’Orco will keep 40% voting rights, while the foundation will drop its percentage of rights but retain veto power for all major company decisions.

Armani Group’s new ownership structure

Outside of the company, Giorgio was just as meticulous in his personal will. He divided all of his assets, from real estate to objects, with thoroughness and thoughtful consideration. He was flexible, too, empowering his beneficiaries to redistribute items by mutual consent.

A man of his word

In a final interview before his death, Giorgio shared his vision for succession:

“My plans for succession consist of a gradual transition of the responsibilities that I have always handled to those closest to me, such as Leo Dell’Orco, the members of my family, and the entire working team. I would like the succession to be organic and not a moment of rupture.”

He lived up to his words and left no details to chance. Through his careful and deliberate planning, his legacy will live on exactly as he intended it.

CMG has seen firsthand how business founders and builders like Giorgio grapple with succession and fail to get this critical topic over the finish line. Difficulties with family issues, tax liabilities, and management succession can overwhelm even the dedicated.

“Since Giorgio Armani had no lineal family descendants, he had an even more difficult task to confront — but confront it, he did. His succession and estate plan is elegant, perfectly suited to his unique set of circumstances, and, as Giorgio put it, it’s “organic and not a moment of rupture.” Giorgio Armani’s example is an inspiration to those of us, including CMG, who are dedicated to ensuring the legacy and opportunity of great family businesses.” — Peter Creaghan, CMG Partner

Further reading:

- Financial Times: The last interview with Giorgio Armani

- Forbes: Inside Giorgio Armani’s Will: Here’s Who Gets What From Billionaire’s Fortune

- Crain Currency: Armani’s ‘elegant’ succession plan is a model for wealthy families

- Financial Times: Giorgio Armani named LVMH and L’Oréal among preferred buyers for fashion empire

- The Wall Street Journal: Giorgio Armani Lays Groundwork for Future of His Fashion House

- Reuters: Explainer: Armani after Giorgio Armani: key details of his will

Jessika McQueen is a freelance writer from Toronto.

Download and read this story as a PDF here.